A single corporate announcement can sometimes do more damage to a stock than months of weak performance. That reality became evident when Kaynes Tech’s share price declined by more than 7% in one trading session following a management update related to forward revenue expectations.

At first glance, such a fall may look alarming—especially for retail investors who associate sharp declines with fundamental deterioration. However, market history repeatedly shows that price reactions and business reality often move on different timelines.

This article takes a deep, experience-driven look at what actually happened, why the market reacted so aggressively, how experts are interpreting the move, and what investors should realistically expect from Kaynes Technology going forward.

Company Overview: Understanding Kaynes Technology’s Core Strength

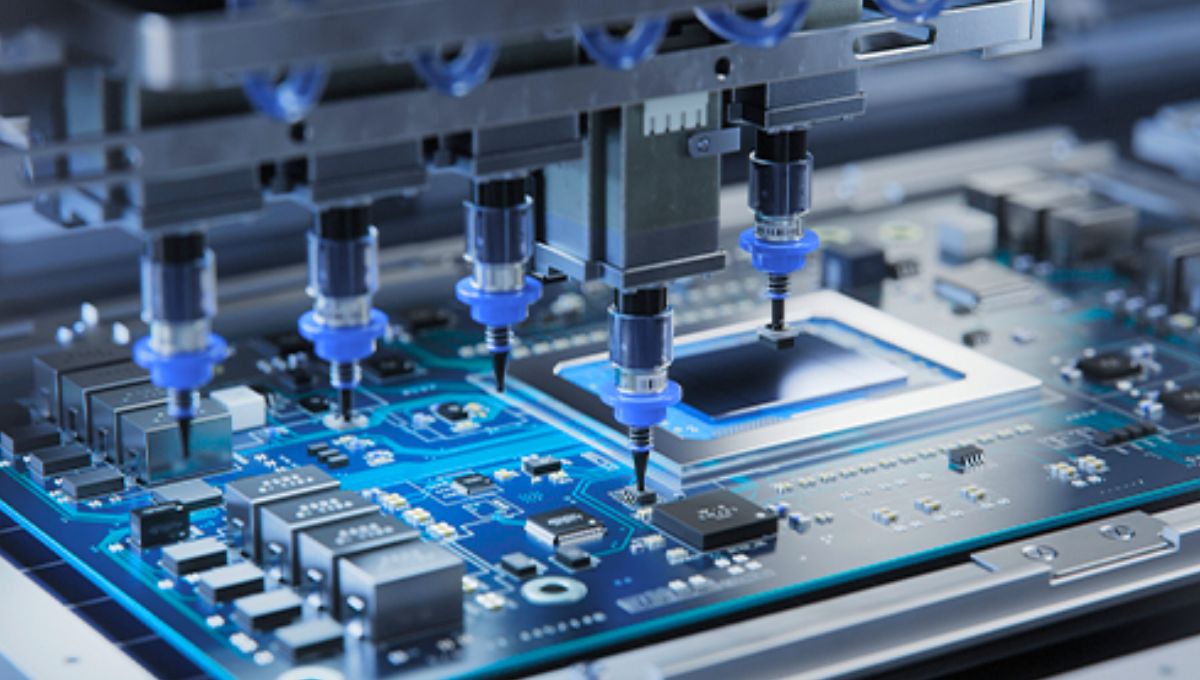

Kaynes Technology India Limited operates in India’s fast-growing Electronics System Design and Manufacturing (ESDM) space. Unlike basic contract manufacturers, the company provides end-to-end electronic solutions, covering design, engineering, manufacturing, testing, and lifecycle support.

This integrated model places Kaynes in a relatively high-entry-barrier segment of the electronics manufacturing industry.

Key Business Segments

- Automotive electronics and EV components

- Industrial and automation electronics

- Railways and aerospace systems

- Medical electronics

- IoT and smart infrastructure solutions

This diversification helps reduce dependence on any single sector and improves long-term revenue stability.

What Was the Announcement That Impacted Kaynes Tech Share Price?

The market reaction was triggered by a revision in forward revenue guidance. Management adopted a more conservative outlook for the upcoming financial year, citing execution timelines and cautious planning amid global uncertainty.

It is important to clarify what this announcement was not:

- It was not a profit warning

- It did not involve losses or margin collapse

- It did not indicate governance or balance-sheet stress

Instead, it reflected a recalibration of expectations, something markets tend to punish sharply when optimism is already priced in.

Read more:- The 6 iPhone 18 Pro Max Leaks Raise an Uncomfortable Question About Apple’s Direction

Why Did Kaynes Tech’s Share Price Fall More Than 7%?

1. Elevated Market Expectations

Before the announcement, Kaynes Tech was trading at valuations that assumed strong and uninterrupted growth. Any moderation—however rational—was bound to trigger a correction.

2. Sentiment-Driven Selling

Retail-heavy participation amplified volatility. As prices slipped, stop-loss triggers and short-term exits accelerated the fall.

3. Technical Factors

Algorithmic trading and momentum-based strategies often exaggerate price moves when key technical levels are breached.

The result was a sharp decline that reflected market psychology more than business weakness.

Business and Financial Specifications (Key Investor Specs)

Operational Specifications

| Parameter | Details |

| Industry | Electronics Manufacturing Services |

| Business Model | Integrated design-to-manufacturing |

| Manufacturing Type | High-mix, low-to-medium volume |

| Client Nature | Long-term, regulated industries |

| Entry Barriers | High |

Financial Health Specifications

| Metric | Status |

| Revenue Trend | Growing, moderated pace |

| Operating Margins | Stable |

| Debt Levels | Low |

| Cash Flow | Healthy |

| Order Book Visibility | Strong |

These specs indicate that the foundation of the business remains intact, despite short-term uncertainty.

How Market Experts Are Interpreting the Correction?

Long-Term Investors Are Not Panicking

Institutional and seasoned investors typically do not react aggressively to a single guidance revision. Instead, they reassess assumptions and wait for execution clarity.

Value-Oriented Investors Are Re-Evaluating Valuations

The decline has made valuations relatively more reasonable compared to earlier levels, prompting closer scrutiny rather than outright rejection.

Traders Are Respecting Volatility

Short-term participants are focusing on risk management rather than directional conviction, acknowledging heightened uncertainty.

Why Conservative Guidance Is Not Always a Red Flag?

Experienced investors understand that conservative guidance can:

- Improve execution credibility

- Reduce the risk of future earnings surprises

- Reset unrealistic expectations

Markets often react negatively in the short term but reward disciplined execution over longer periods.

Industry Tailwinds Still Support the Business

Kaynes Technology continues to benefit from several structural trends:

- Government focus on domestic electronics manufacturing

- Import substitution in high-value electronics

- Rising demand from EV, automation, and industrial sectors

- Increasing complexity of electronic systems

None of these drivers were impacted by the recent announcement.

Risks That Investors Should Monitor Carefully

No analysis is complete without acknowledging risks.

Key Risk Factors

- Execution delays in large projects

- Margin pressure due to cost inflation

- Sensitivity to valuation re-rating

Awareness of these risks allows investors to make informed, not emotional, decisions.

Kaynes Tech Share Price: Short-Term vs Long-Term Outlook

Short-Term Outlook

- Volatility is likely to remain

- Market sentiment will drive price movement

- News flow may cause sharp swings

Long-Term Outlook

- Performance will depend on execution

- Order inflows and margins will be critical

- Fundamentals, not sentiment, will dictate value

History shows that strong manufacturing businesses tend to outlast short-term market noise.

Panic Signal or Strategic Pause?

The recent decline in Kaynes Tech’s share price appears to be an expectation reset rather than a structural breakdown. While caution is justified, panic selling is not supported by fundamentals.

For informed investors, this phase is less about reaction and more about discipline, patience, and continuous monitoring of execution.

FAQs

Why did Kaynes Tech’s share price fall suddenly?

The stock declined after the company revised its forward revenue guidance, leading to short-term market disappointment.

Does the fall indicate financial weakness?

No. The company remains financially stable with healthy margins, low debt, and a strong order book.

Should long-term investors be worried?

Long-term investors should focus on execution and fundamentals rather than short-term price volatility.

Is this a buying opportunity?

Experts suggest a staggered approach rather than aggressive entry, depending on risk appetite.